(News Release)

Africa’s global bank, United Bank for Africa (UBA) Plc, is set to launch the new internet banking, tagged ‘Made for Love’ in time for the Valentine season which is widely celebrated all over the world as the season of love.

The newly upgraded internet banking has been fully equipped to provide a new digital experience to customers as the bank has invested in cutting edge technology to achieve this with attention to the smallest detail.

UBA’s Group Managing Director/Chief Executive Officer, Kennedy Uzoka, who gave insight on the new internet banking system, explained that as always, UBA remains committed towards prioritising customers, which is why the bank has gone the extra mile in conceptualising an outstanding service, with countless benefits and features designed to give its esteemed customers increased control and accessibility to carry out their transactions with ease.

As a key part of the new features, he said the application has been loaded with security elements to protect all financial transactions on the bank’s platform and is securely focused on the ultimate customer experience.

Speaking specifically about the internet Banking payment system, the GMD explained that it is the best in its class and was designed with multiple-factor authentication security features, which makes it extremely difficult to hack. He, however, advised customers not to divulge personal information to third parties, in order to keep the line of transaction fully protected on the part of the customer.

“The new Internet banking comes with a lot of features that are engaging for customers and have made banking transactions a lot easier, while easily addressing customers’ needs, through inbuilt emerging technologies like Artificial Intelligence (AI),” Uzoka said.

He listed some of the upgraded features to include transfer of money from UBA account to other UBA accounts, sending money to saved beneficiaries, card-less withdrawal for self and for third party, personal financial management and so much more.

“Mobile technology is our strategy in UBA, and we have devoted a lot to ensure that we are able to deliver banking services using a web system that is unparalleled across the globe”, Uzoka explained.

Also speaking on the new digital experience, Group Head, Digital Banking, Kayode Ishola, said the new internet banking is the customers’ personal finance manager built with a distinctive user interface that will change the face of banking, adding that the internet banking has been designed as multilingual and multi-currency Web payment system to address the needs of all categories of UBA customers, irrespective of their education and tribe, either for Individual customers or SME customers.

He disclosed that the new Internet banking runs concurrently in the 20 countries of UBA’s operation, interacting in the different languages and cultures in line with the specific needs and regulation of the country in focus, adding that it is sleek and trendy with a seamless user interface and can also speak to the specific country where it is being used.

“Interestingly, we have worked towards creating behavioural insight for our customers and working around this to address the real needs of our customers using the Omni channel platform and running on our open digital platform, which is very interactive and armed with lifestyle services,” Ishola explained.

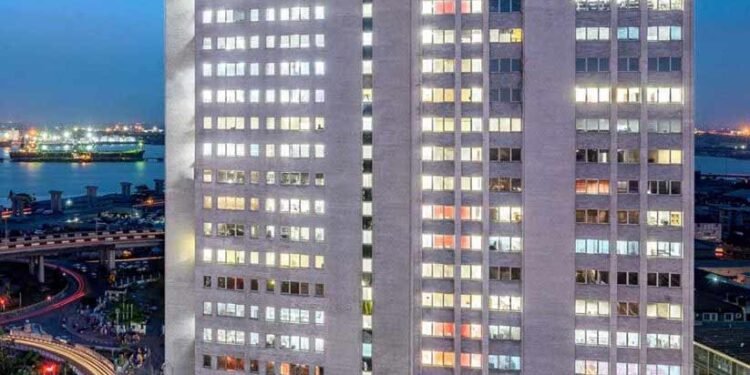

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than twenty-one million customers, across over 1,000 business offices and customer touch points, in 20 African countries.

With presence in the United States of America, the United Kingdom and France, UBA is connecting people and businesses across Africa through retail; commercial and corporate banking; innovative cross-border payments and remittances; trade finance and ancillary banking services.