By Seyi Babalola

The Senate has urged the administration against boosting the budget size through a supplementary budget, instead encouraging the government to use excess savings from the recent naira devaluation to pay the deficit.

This occurred against the backdrop of the local currency’s decline against the US dollar from N900/$r to more than 1,500/$, after a series of steps by the Central Bank of Nigeria to harmonize the parallel and official market exchange rates of the naira.

In December, the National Assembly increased the 2024 budget benchmark exchange rate from N750/dollar, as proposed by President Bola Tinubu, to N800.

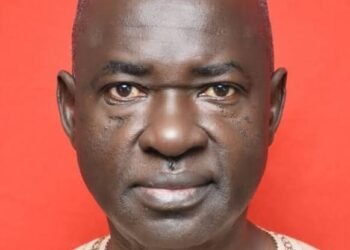

Giving reasons at that time, the Chairman of the Senate Committee on Appropriation, Senator Solomon Adeola, explained, “The current price of the dollar at the black market is between N1200 and N1300 and in the Central Bank of Nigeria, it is between N950 and N1000 and we have a budget which was pegged at N750, if you look at the gap, you’d realise that has covered a lot of gaps already.”

“Again, we did some external consultations, most especially in the area of oil benchmark and petroleum resources, if we had gone in that line, we’d have pegged it at N850/N900 to a dollar and we agree that we want to be conservative in our approach, so that nobody will think that we want to increase the budget for any ulterior motive, that was why we left it at N490bn out of which N44bn is for statutory transfer, so effectively, the increment is about N446bn that is going into the Federal Government pocket as consolidated revenue.”

“So, you can see that what necessitated our action is the economic reality and what is obtainable in both the black and open markets.”

However, following the depreciation of the naira from N900/dollar to over N1,500/dollar, the Senate has advised the Federal Government against increasing the budget size, saying the move could worsen the country’s already high inflation rate.