By METROWATCH Reporter

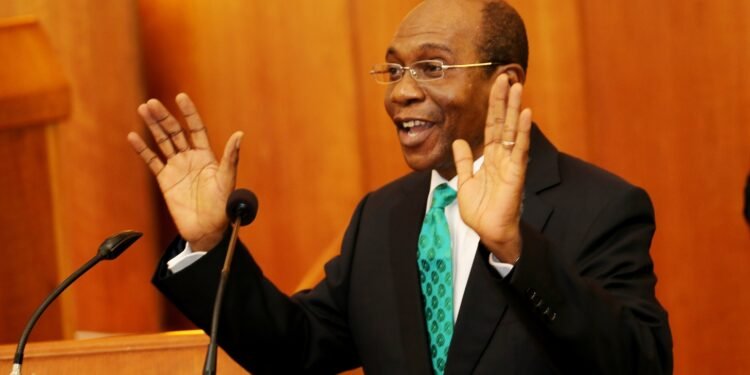

Governor of the Central Bank of Nigeria (CBN), Mr Godwin Emefiele, has formally unveiled the Nigerian national domestic card scheme, known as AfriGo, in a significant move to strengthen the national payments system and deepen the usage of electronic platforms in Nigeria.

Unveiling the first Central Bank-led domestic card scheme in Africa in a virtual ceremony on Thursday, January 26, 2023, Mr. Emefiele said the new card scheme, done in collaboration with the Nigeria Inter-bank Settlement System (NIBSS), would provide more options for domestic consumers while also promoting the delivery of services in a more innovative, cost-effective and competitive manner.

According to him, “the scheme is important to plug in the gap that has remained in the economy since the introduction of the cashless policy, and will integrate the informal segment of our economy, reduce shadow banking, bring more Nigerians into the formal financial services with an attendant diversification of deposit portfolio which will further strengthen the stability of the banking industry”.

He noted that, though the penetration of card payments in Nigeria had grown tremendously over the years, many Nigerians were still excluded, adding that the challenges of financial inclusion in the country were the high cost of card services as a result of foreign exchange requirements of international card schemes, as well as

the inability of existing card products to address local peculiarities of the Nigerian market.

While assuring that the national domestic card would be accessible to all Nigerians and address most of the country’s local peculiarities, he further stated that it was not a quest to prevent international service providers from continuing to provide services in Nigeria.

Instead, he said it aimed at domestic consumers whilst also promoting the delivery of services in a more innovative, cost-effective and competitive manner.

In her welcome remarks, the Deputy Governor (Financial System Stability) at the Central Bank of Nigeria, Mrs. Aishah Ahmad, said that the Nigerian national domestic card scheme would lead to the sovereignty of data, saves cost on card transactions, reduce foreign exchange pressure and would present new opportunities for the Nigerian economy.

Mrs. Ahmad, who doubles as Chairman of the Nigerian Interbank Settlement System (NIBSS), further said the card scheme “heralds a new vista of opportunities for the card business, that several countries continue to recognise and leverage as they create their domestic card schemes to augment existing foreign payment card rails.”

According to her, the card scheme also provides an essential platform for further innovation to solve some of the most pressing issues around financial inclusion, SME payments and trade facilitation primarily, supporting the drive for a robust digital economy for the Nigerian market, the African continent and the world.

Giving an overview of the card, she said the name for the national domestic card scheme, AfriGO, was birthed in Nigeria with continental aspirations, as ‘AFRI’ means culture, ethnic diversity, bravery, innovation, and growth while “GO” symbolises progress, empowerment, inclusivity, and future-forward amongst others.

Also speaking, the Managing Director of NIBSS, Premier Owoh, listed the security features of the AfriGO card scheme, which includes a smart chip, the CVV Code, and the NQR embedded signatures, amongst others.